Story: Understand the business

When you work at the company, you don’t have to much care about tax. Even you may not know how much gross income you are earning per month. Because company already deducts a tax from your paycheck.

Once you register your business as freelance, you have to pay tax to authorities, city, province or government. This is a basic process in any countries, I believe. If it’s in Japan, I can visit the facility near me. However, I cannot find any services which CRA helps tax matters in face to face. I can ask it to the accountant and it’s the easiest way. However, I want to understand this process and solve the problem by myself. This is notes what I found on internet.

– The Social Insurance Number (SIN) is a nine-digit number that you need to work in Canada or to have access to government programs and benefits. – Canada.ca/sin

– Once you earn the money, your tax is already deducted from a paycheck. However, you can apply tax returns. – Canada.ca/taxes

– Business and industry: Business taxes, permits and regulations, intellectual property, business support and how to sell to government. – Canada.ca/business

Canada Revenue Agency

The Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and for most provinces and territories, and administers various social and economic benefit and incentive programs delivered through the tax system. – CRA

GST/HST

The Federal GST (Goods and Services Tax), a 5 percent tax on most Canadian goods and services, began on January 1, 1991. – The Balance Small Business

Harmonized Sales Tax, commonly referred to as HST, is a consumer tax resulting from the combination of the Canadian federal Goods and Services Tax (GST) and provincial sales tax (PST). – The Balance Small Business

Duty & Accountability

Many of you may think, I don’t want to pay tax. I know how you feel. First year, I didn’t understand about tax. CRA sent me letters couple of times. I didn’t pay attention. In my business period (May 1st, 2016-December 31th, 2016), I have to pay tax in the end of April. I had to file on CRA website by June 15th.

Extra resources

©Jessica Moorhouse

Gross: All of the money you earn from your business

Net: Gross amount minus your expenses

*Reference: MBO

You may need to know:

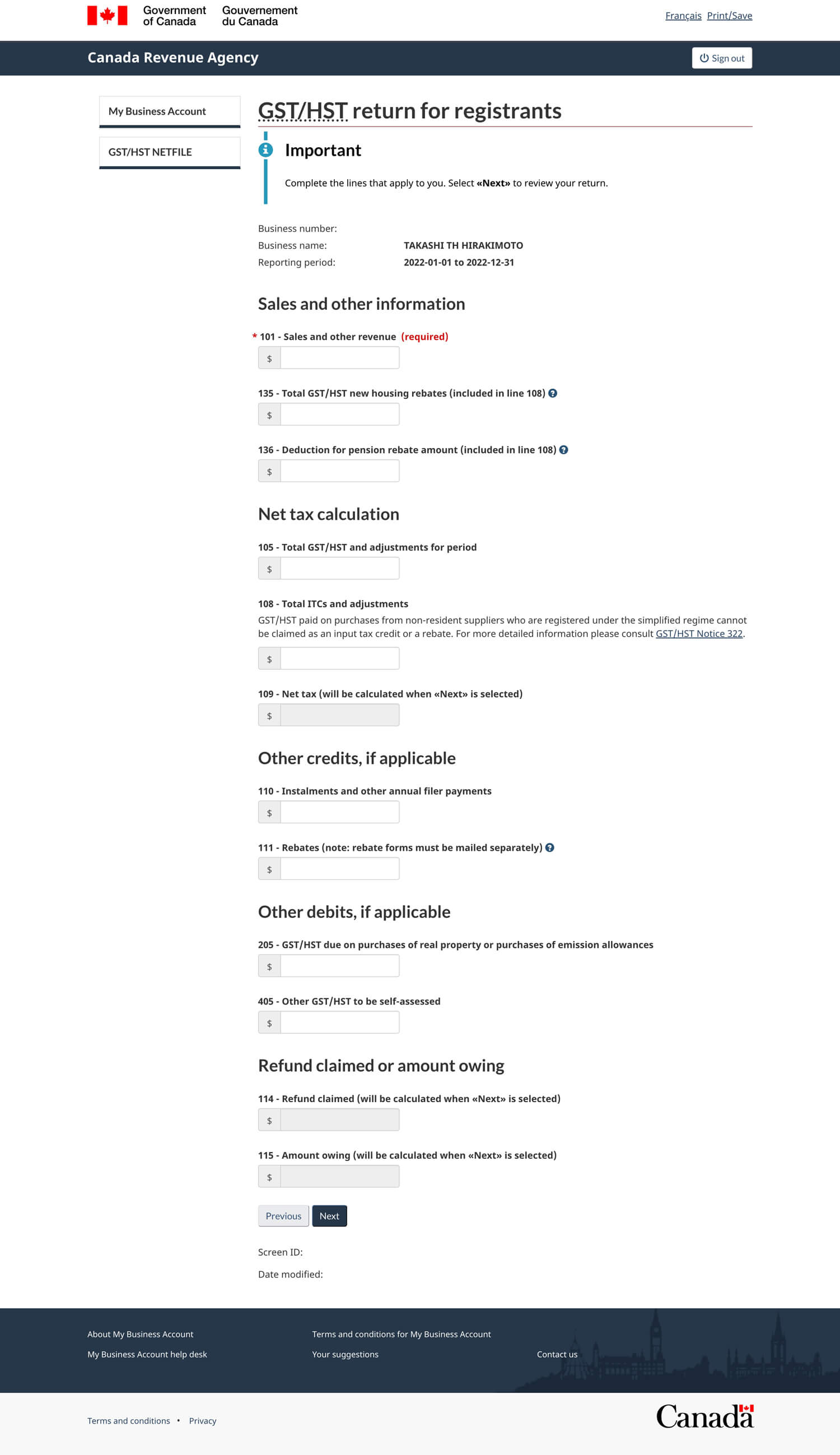

101: Total sales

105: GST/HST

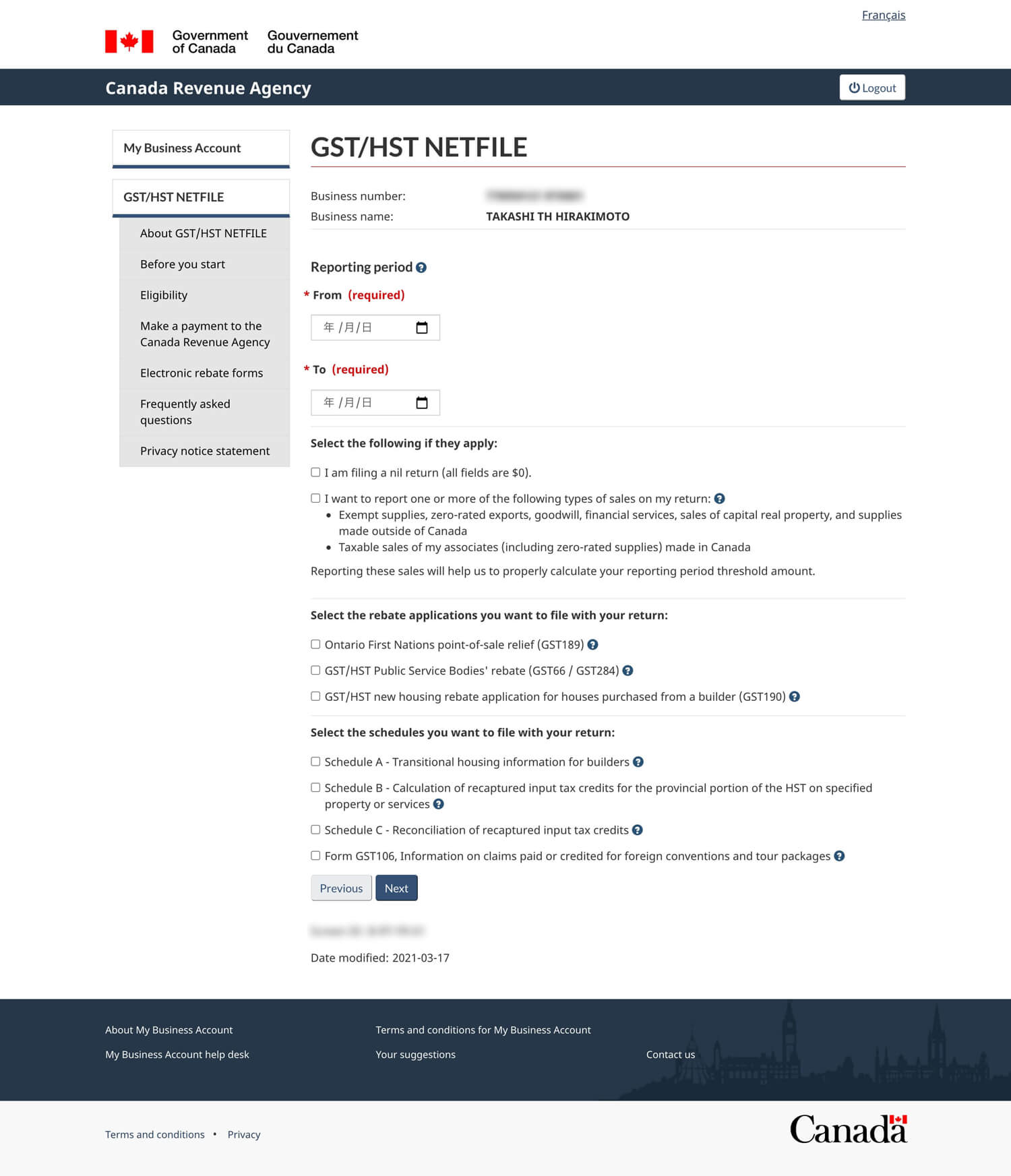

Filing Process

Access to Canada.ca

– Option 1: Using one of our Sign-In Partners

– Option 2: Using a CRA user ID and password

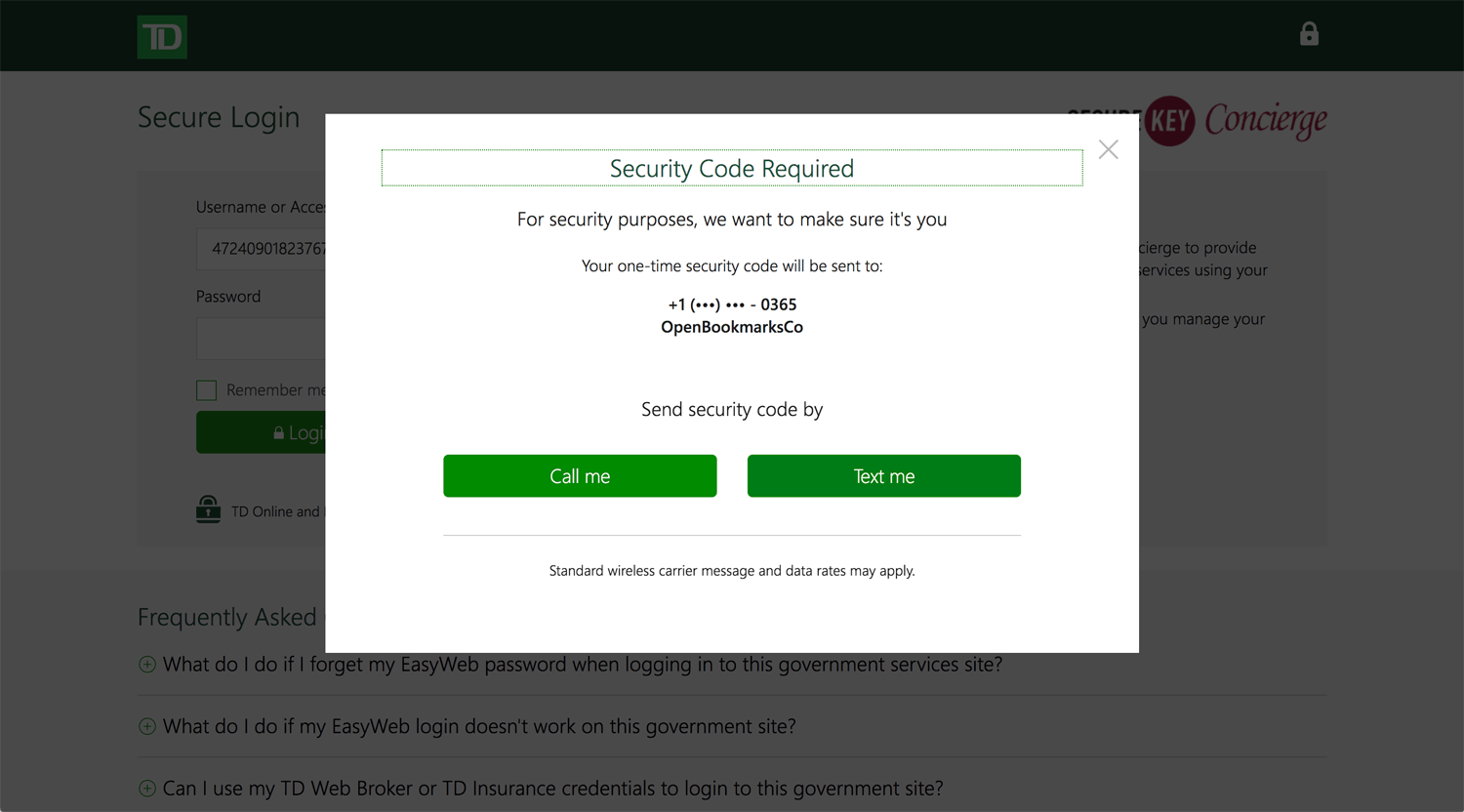

I normally use a bank account. I don’t remember CRA user ID/PW.

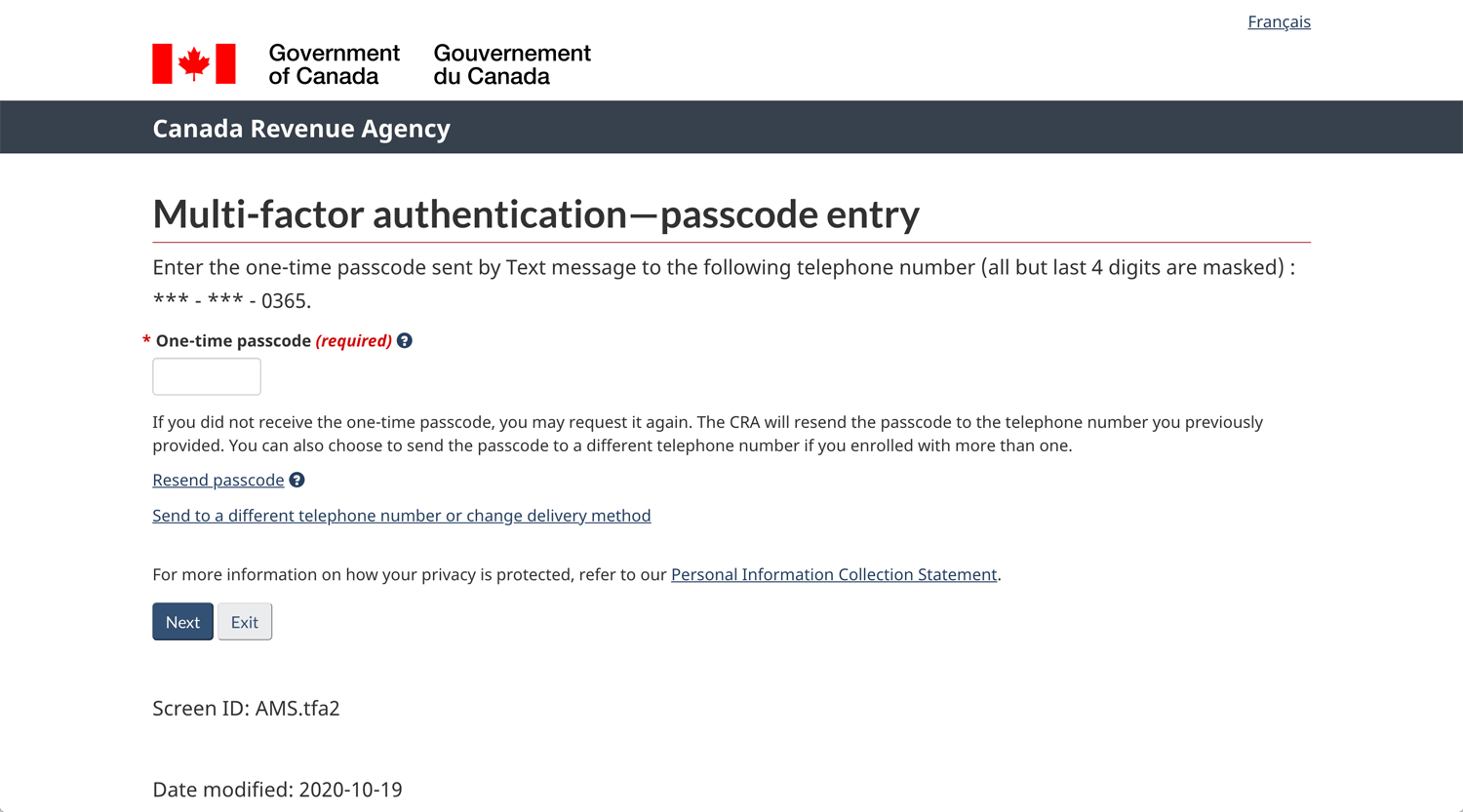

When I choose the main bank, they ask code which sends to me by text. After that, CRA asks me the same. I feel it’s unnecessary because already did it before, but anyway.

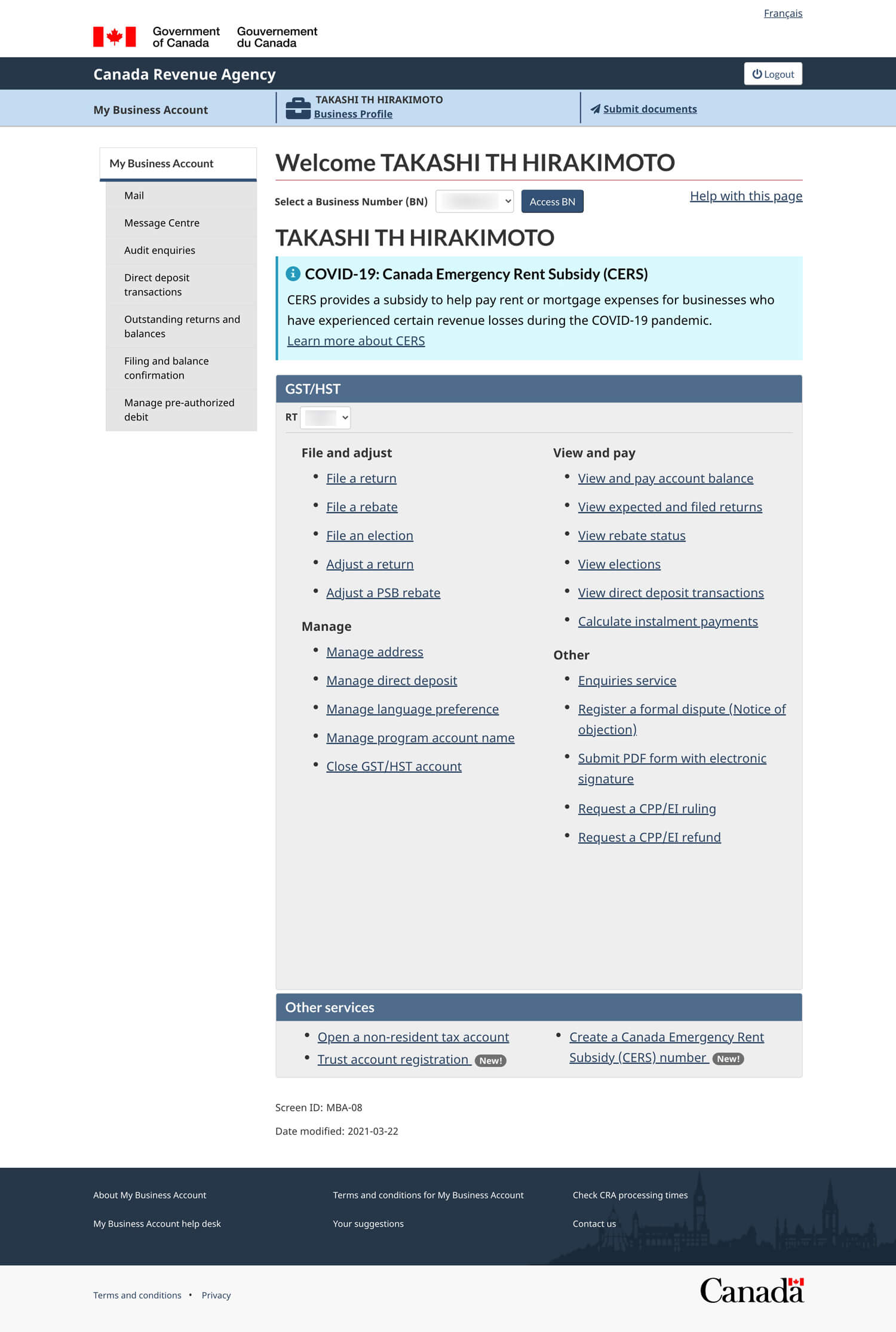

Top screen after login.

– File a return

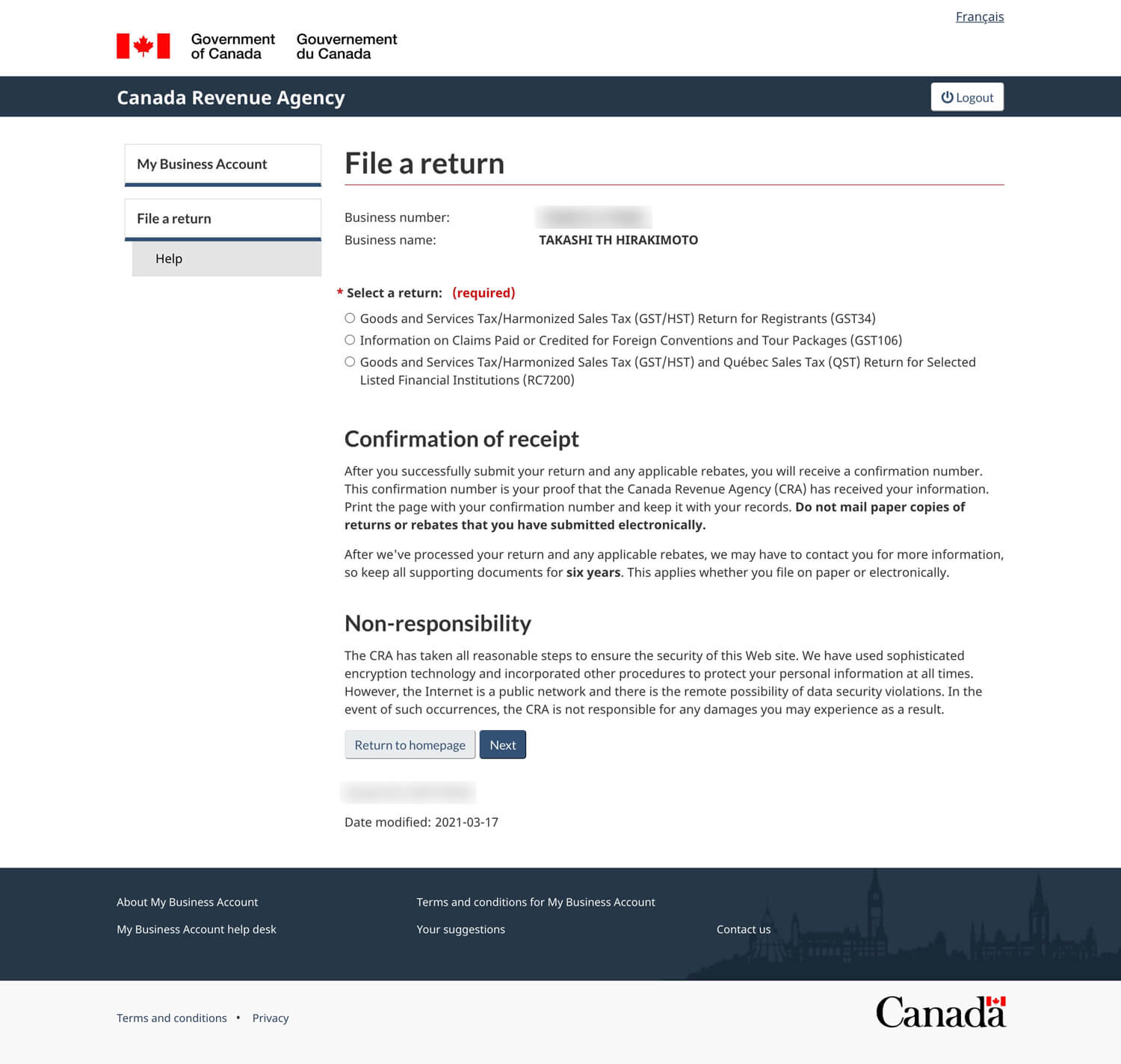

– Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return for Registrants (GST34)

This is in my case. Others may need to check at the different boxes.

This page makes me confused. After all, I did not need to check anything.

I already filed each facial year since I have started a freelance. I am going to update next year.

101: Total sales (net, not gross)

103 – GST/HST collected or that became collectible in the reporting period (Total GST for pay tax)

105: GST/HST (cannot input)

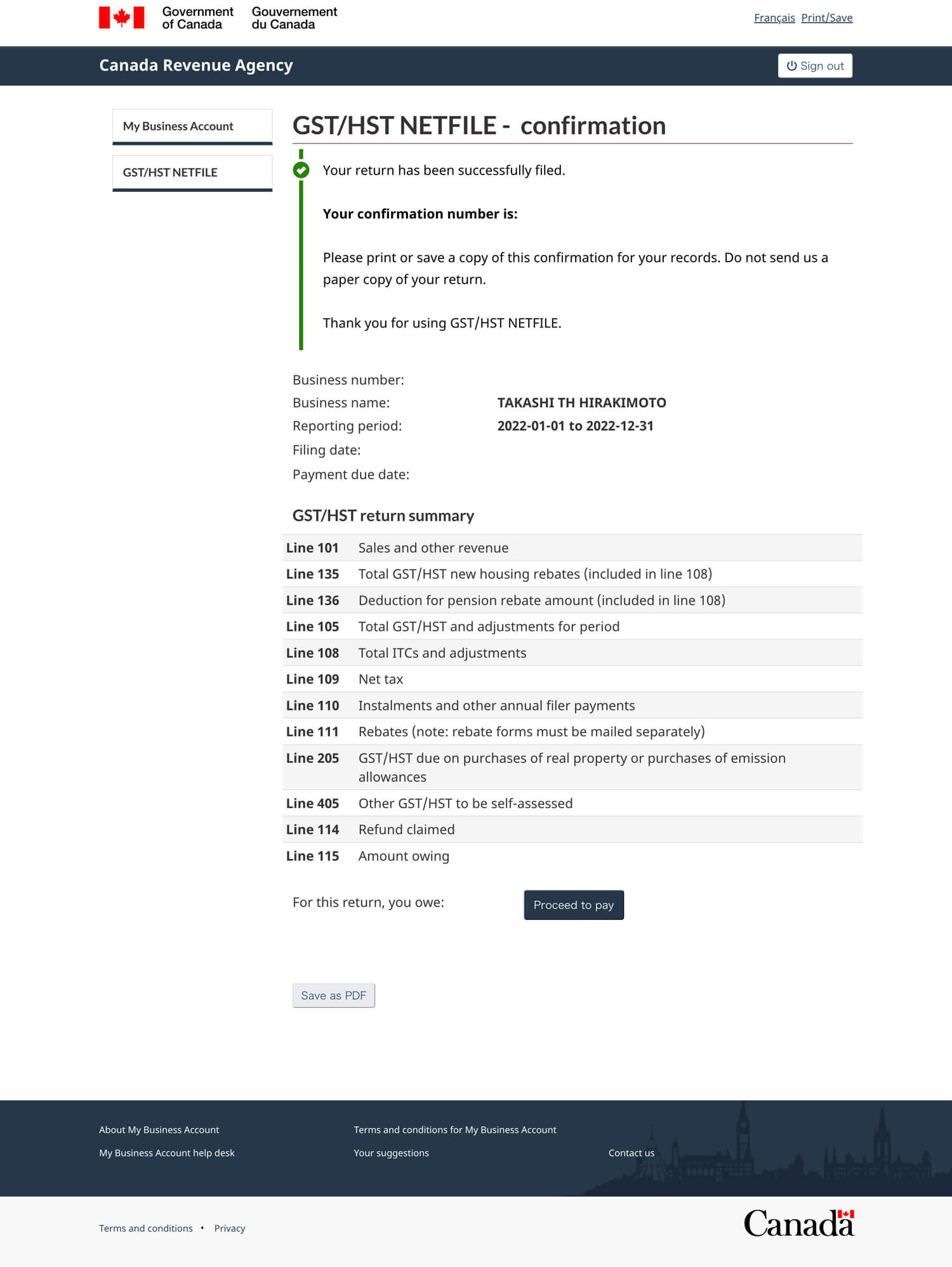

Done!

What Are Input Tax Credits?

I filed GST/HST, but I still had a question. How to tell my expenses to CRA? Before that, which expenses can I count? – The Balance Small Business

At the end of March, I am organizing accounting information rather than design work. I should do this daily or monthly.

Reference:

wikiHow: How to Complete a Canadian GST Return?

Kashoo: Filing a GST/HST Return with the Canada Revenue Agency (CRA)